- Knowledge

Advantages of Spanish company registration

1. Market and Strategic Position

EU Portal: Radiating 500 million EU consumers, enjoying zero tariffs and unified standards within the EU.

Latin American Bridge: Language and cultural advantages, covering a market of 600 million people in Latin America.

2. Tax incentives

Corporate income tax: The standard tax rate is 25%, and the tax rate for small and medium-sized enterprises (profits ≤ 200000 euros) is 23%.

R&D incentive: R&D investment can offset up to 42% of taxes.

Free Trade Zone Policy: The Canary Islands (ZEC) has a corporate income tax of only 4% and is exempt from Value Added Tax (VAT).

3. Business convenience

Digital registration: The entire process is handled online, and the company establishment can be completed within 72 hours at the fastest.

Equality of foreign investment: No industry access restrictions (except for sensitive areas such as national defense), allowing 100% foreign ownership.

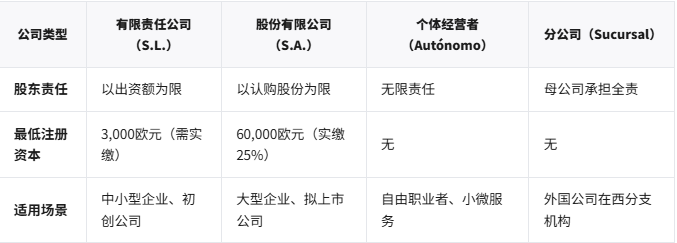

1、 Types of Spanish companies

01. Limited Liability Company (S.L.)

Shareholder liability: limited to the amount of capital contribution

Minimum registered capital: 3000 euros (to be paid in)

Applicable scenarios: Small and medium-sized enterprises, startups

02. Sociedad An ó nima, S.A

Shareholder liability: limited to subscribed shares

Minimum registered capital: 60000 euros (paid in 25%)

Applicable scenarios: Large enterprises, companies planning to go public

03. Sole proprietor (Aut ó nomo)

Shareholder Liability: Unlimited Liability

Minimum registered capital: none

Applicable scenarios: freelancers, small and micro services

04. Branch (Sucursal)

Shareholder Responsibility: The parent company bears full responsibility

Minimum registered capital: none

Applicable scenario: Foreign companies' branches in the west

2、 Core Requirements for Spanish Company Registration

01. Shareholders and Directors

At least one shareholder (natural person/company), no nationality restrictions.

At least one director (who may overlap with shareholders), without the need for Spanish residents.

02. Company Name

The name needs to be approved by the Registro Mercantil, with the suffix indicating the type (such as "S.L.").

03. Registered address

Actual address within Spain must be provided (virtual office can be rented).

04. Registered capital

S.L.:3, 000 euros, fully paid in.

S.A.:60, 000 euros, with at least 25% paid in during registration.

3、 Spanish company registration materials

(1) Shareholder/Director Identity Documents

Natural person: Copy of passport (requires Spanish notarization and authentication).

Shareholders of the company: Parent company registration certificate, articles of association, authorization letter (requiring Hague certification).

(2) Articles of Association (Estatutos Sociales)

Clarify the company name, capital, business scope, and governance structure, which requires a Notario signature.

(3) Proof of Registered Address

Lease contract or property ownership certificate (including tax identification code).

(4) Bank credit certificate

Certificate of registered capital deposit issued by a Spanish bank (only required for S.L./S.A.).

4、 Spanish company registration process

Step 1: Check for duplicate names (1-2 days)

Submit 3 alternative names to the Business Registration Bureau (online processing).

Step 2: The notary office signs the document (1 week)

Shareholders/directors sign the company's articles of association (with remote authorization).

Step 3: Apply for a Tax ID Number (NIF) (2-3 days)

Apply for a temporary tax identification number (NIF Provisional) from the tax bureau (AEAT) and convert it to a permanent tax identification number.

Step 4: Business Registration (2-4 weeks)

Submit the notarized documents to the Business Registration Bureau and receive the company registration certificate.

Step 5: Social security and bank account opening (1-2 weeks)

Register social security (TAE number) for employees and open a corporate bank account.

5、 Precautions for registering a Spanish company

1. Tax declaration

Enterprise income tax (IS) is declared annually, and value-added tax (IVA) is declared quarterly.

The penalty for failure to declare is 20% -150% of the outstanding tax amount.

2. Annual Report

Submit annual financial statements (Cuentas Anuales) to the Business Registration Bureau.

3. Localization requirements

Employees must comply with the Labor Law (Estatuto de los Trabajadores) and have a maximum probationary period of 6 months.

4. Accounting and auditing

Companies with annual revenue exceeding 6 million euros or assets exceeding 2.85 million euros are required to undergo mandatory audits.

6、 Common Problems in Spanish Company Registration

Can non residents register their company remotely?

sure. Entrust a Spanish lawyer or agent to handle the matter through an authorization letter (Poder Notarial), without the need for physical presence.

What taxes and fees do I need to pay after registration?

Corporate income tax: 23% -25%.

Value added tax: Standard tax rate of 21% (10% for food/medicine and 4% for basic products).

Property tax: levied at 0.5% -2.5% of the company's net asset value.

What if the company name is rejected?

Change the name and resubmit. It is recommended to add industry keywords (such as "Tech Solutions S.L.").

What are the social security costs for individual business owners (Aut ó nomos)?

Approximately 300-600 euros per month, including basic social security (medical/pension/unemployment).