- Knowledge

Advantages of Singapore Company Registration

Strategic Location: Singapore's strategic position in Asia enables it to easily enter regional markets, making it an international business center.

A sound legal system: The country has a comprehensive legal system that upholds the rule of law and ensures fairness and transparency in commercial transactions.

Good business environment: Thanks to efficient regulatory processes and a friendly business environment, Singapore has consistently ranked among the top in the global ease of doing business index.

Tax incentives: Singapore offers a competitive and transparent tax system with lower corporate tax rates. In addition, there are various tax incentives and reduction policies to encourage the development of enterprises.

Acquiring global talent: The country attracts technical professionals from around the world, providing businesses with a diverse and talented workforce.

Financial Center: As a leading global financial center, Singapore provides advanced banking and financial services, promoting international trade and investment.

Quality of Life: Singapore offers a high-quality lifestyle with a safe environment, excellent healthcare, education, and an international lifestyle.

Global reputation: Registering a company in Singapore can enhance the global reputation of your business, thereby boosting the confidence of customers, investors, and partners.

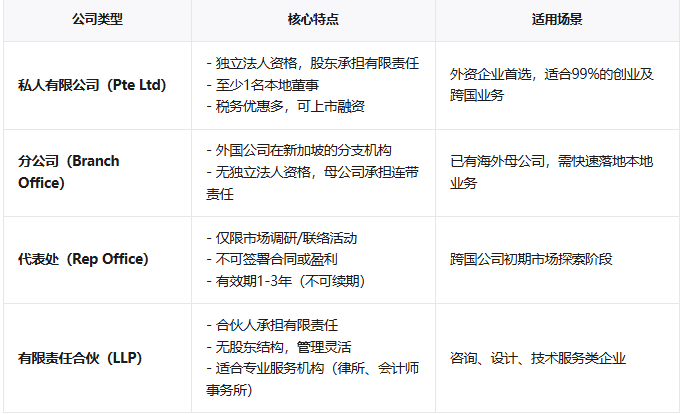

1、 Types of Singaporean Companies

2、 Core Requirements for Singapore Company Registration

01. Shareholders and Directors

At least one shareholder (can be a natural person or a company, allowing 100% foreign investment)

At least one local director (Singaporean citizen/PR/employment permit holder)

One company secretary can be appointed (licensed, usually provided by an agency)

02. Registered capital

Minimum of SGD 1 (recommended SGD 10000 to enhance business reputation)

No need for actual payment, no requirement for capital verification

03. Registered address

Local physical address required in Singapore (PO box not available)

Virtual offices can be rented or provided by agents

3、 Singapore company registration materials

(1) Basic materials

The English name of the company (needs to be approved by ACRA, with the suffix "Pte. Ltd.")

Scanned copies of passports or ID cards of shareholders/directors (non English documents need to be translated and notarized)

Company Articles of Association (usually using standard template MAA)

(2) Additional Files

Parent company registration certificate (required when registering a branch)

Bank credit certificate (additional submission required for financial companies)

4、 Singapore company registration process

Step 1: Approval of Company Name

Submitting a search through the Singapore Accounting and Corporate Regulatory Authority (ACRA) online system costs SGD 15.

Step 2: File Preparation

The agency assists in drafting the articles of association and appointing the company secretary.

Step 3: Submit Application

Submitting through ACRA's BizFile system incurs a government fee of SGD 300.

Step 4: Obtain the certificate

After approval, download the electronic version of BizFile (including the company's unique code UEN).

Step 5: Subsequent steps

Engraving company seal (not mandatory but recommended)

Open a corporate bank account (requires director's in person/video interview)

5、 Notes on Singapore Company Registration

1. Local Director Compliance

If local directors cannot be provided, a proxy agency must be commissioned to provide nominee director services (with an annual fee of approximately SGD 2000-5000).

2. Tax resident status

The company needs to meet the requirements of 'management and control in Singapore' (such as local director decision-making, local board meetings) in order to enjoy tax treaty benefits.

3. Annual review and financial report

An annual shareholders' meeting must be held and an annual review (AGM) submitted, with a maximum penalty of SGD 600 for overdue payments.

Companies with a turnover exceeding SGD 10 million or assets exceeding SGD 10 million are required to have their financial statements audited.

4. Difficulties in opening a bank account

Some banks require a minimum deposit (such as DBS requiring SGD 5000), it is recommended to prioritize choosing OCBC or UOB.

6、 Frequently Asked Questions about Singapore Company Registration

Does registering a Singapore company require actual operation?

✅ Can register a dormant company, but requires normal annual review. If there is no business for a long time, it may be classified as an "inactive company" by ACRA.

How long does it take to complete the registration process?

✅ Electronic registration can be completed within 1 day at the fastest

What tax advantages do Singaporean companies have?

✅ The first 200000 Singapore dollars of profits are exempt from tax (for the first three years of the newly established company), and offshore income is exempt from tax (if the business is actually located in Singapore).

Can Chinese citizens hold 100% ownership?

✅ Sure, Singapore allows foreign investment to fully control without industry restrictions (except for sensitive areas such as defense and media).

How to apply for Goods and Services Tax (GST) registration?

✅ Annual turnover exceeding SGD 1 million requires mandatory registration for GST, otherwise voluntary application (tax rate of 9%) is possible.

Comparison between Singapore and Hong Kong Companies