- Knowledge

According to the examination requirements of the United States Patent and Trademark Office (USPTO) for the qualification of Micro Entities, in order to ensure the compliance of applications and avoid patent invalidation due to disqualification, starting from August 4, 2025, all new US patent applications submitted in the name of Micro Entities must provide proof of Micro Entity qualification. The specific requirements are as follows:

1、 Enterprise applicants need to provide

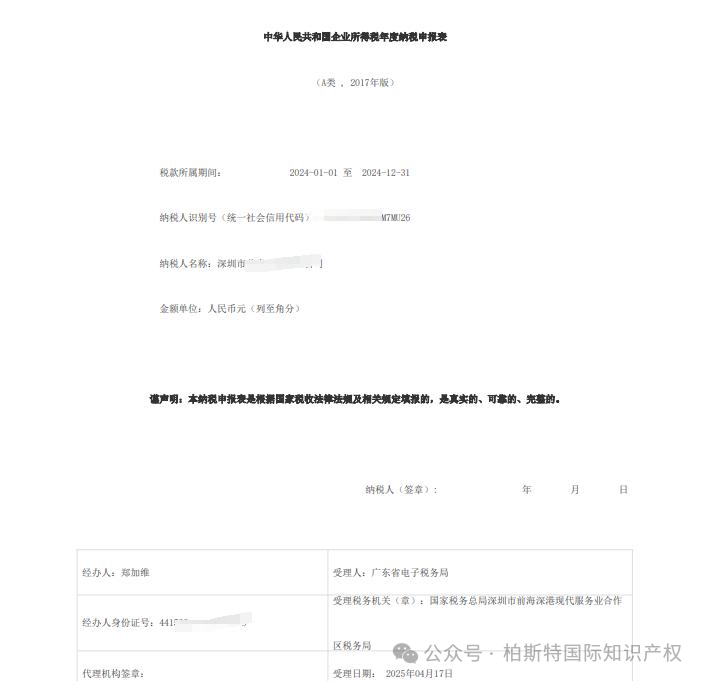

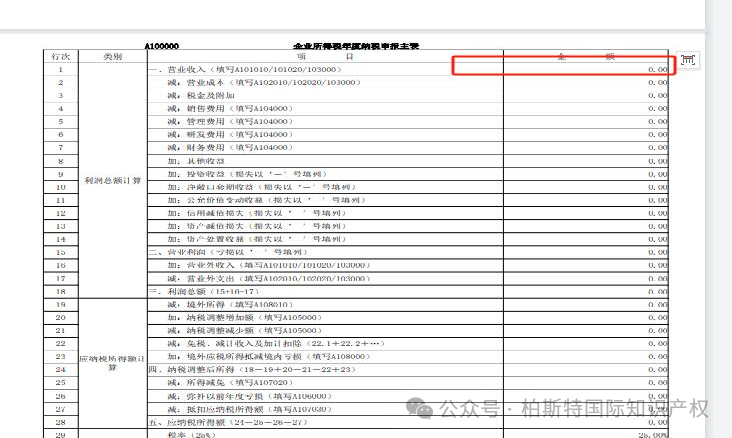

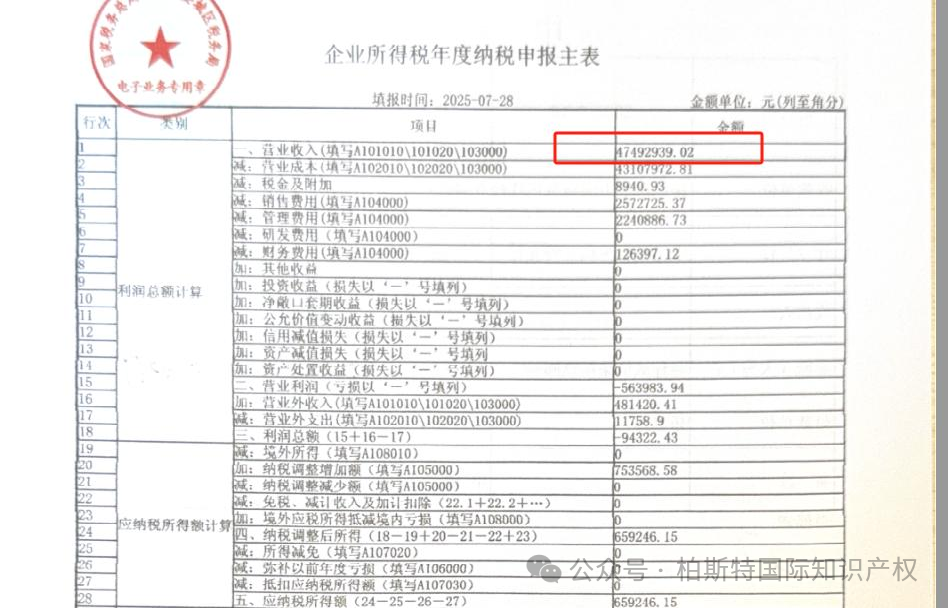

Annual Tax Declaration Form for Enterprise Income Tax of the People's Republic of China:

Prove that the total revenue of the previous year did not exceed the micro entity standard223740 USD (approximately 1655676 RMB)The document needs to be stamped with the company seal (complete scanned copy)

2、 Inventors or individual applicants are required to provide

Screenshot of Personal Income Tax

Display that the individual's total income in the previous year meets the micro entity standard and does not exceed223740 USD (approximately 1655676 RMB)

3、 Precautions

Those who have not submitted proof or materials that do not meet the requirements will be required to pay the difference in fees according to the standards of small or large entities;

2. False statements may result in rejection of the application or invalidation of the patent, please make sure to truthfully declare.

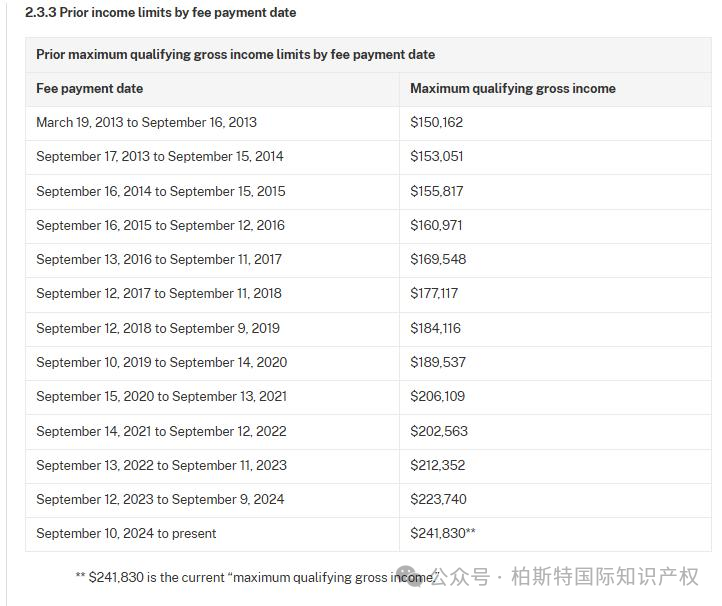

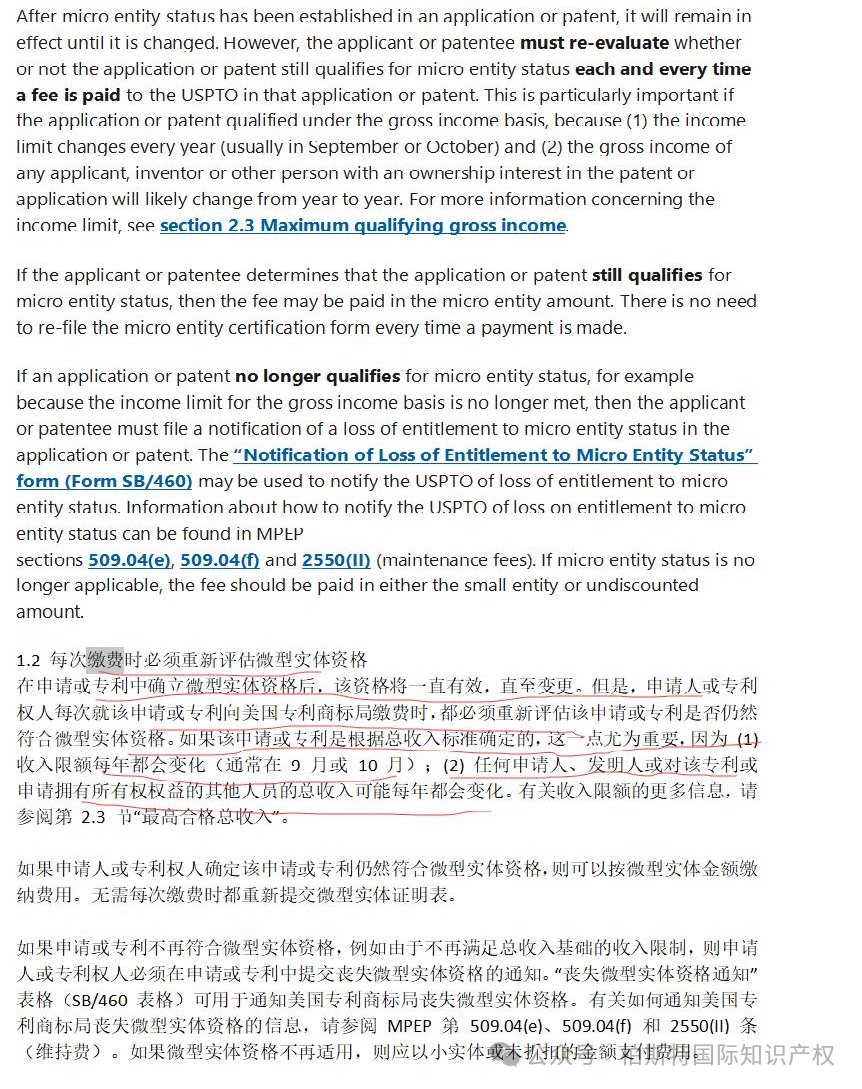

The annual changes in the highest qualified total income are shown in the figure: for reference and comparison

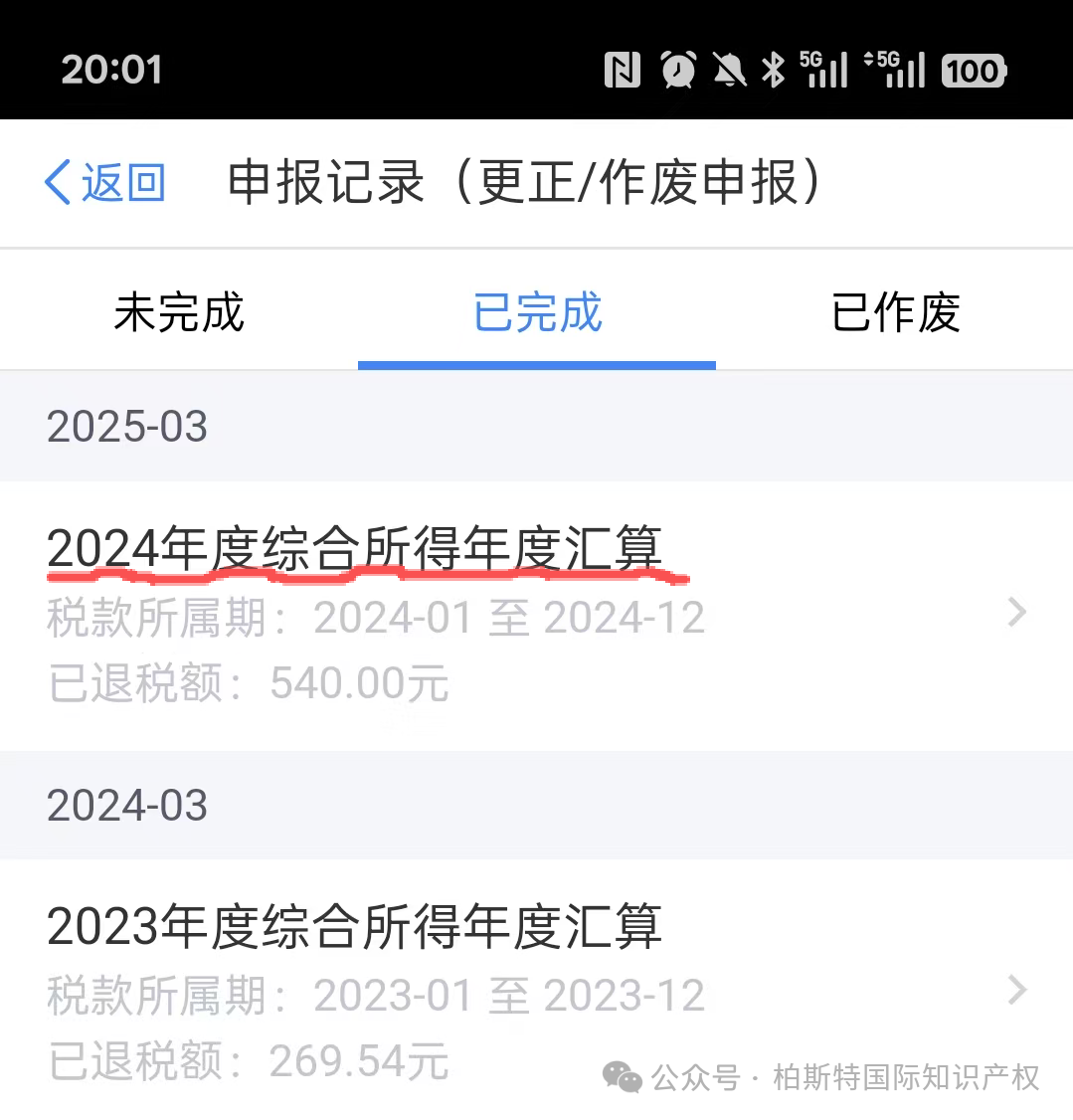

3. Click on the declaration record and select the year of patent application, 24 years

4. Screenshot

5. Screenshots

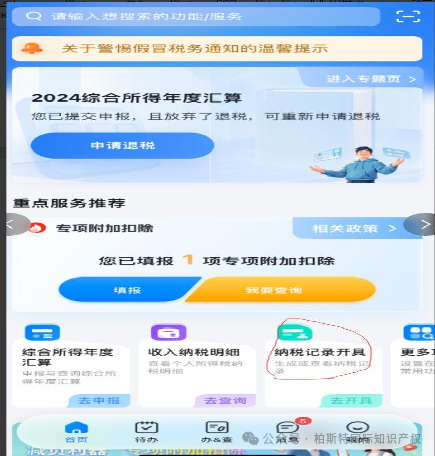

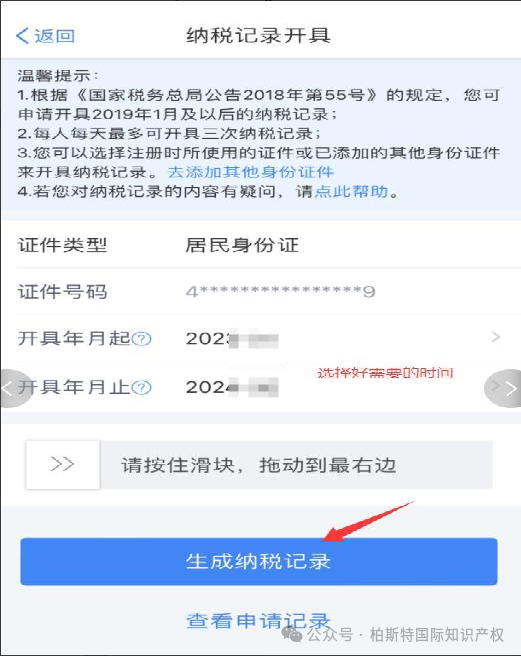

Step 2: Download method for personal income tax payment

1. Click on tax record issuance

2. Choose time - provide the past year, 24 years

3. Select Save and find this image in the album

The picture looks like this, don't code it!

6、 Authorization fee payment must also comply with micro entity standards

If it meets the requirements of the micro entity, the lawyer will issue a signed document, and the applicant will confirm again that the applicant and inventor meet the requirements of the micro entity, supplement the micro entity signed document, and then arrange to pay the authorization fee.

2. If it does not meet the requirements of micro entities, it will be paid according to the official payment of small entities

Attachment:

Micro entity standard (if all four of the following criteria are met, you can enjoy an 80% discount on most official fees)

1. Meet the requirements for small entities;

2. The inventor (applicant) has filed no more than 4 patent applications in the United States;

3. The annual income of each inventor (applicant) in the previous year shall not exceed $223740 (if the applicant is a company, this income refers to turnover, not net profit);

4. The inventor/applicant is not obligated to transfer the invention to any non micro entity third party.

Small entity standard (meeting any of the following conditions is acceptable, with a 60% reduction in most official fees for small entities)

1) Individual natural person;

2) The number of employees in the company shall not exceed 500 (including subsidiaries);

3) Non profit organizations (such as universities);